Key Points

- High school students are placing greater weight on affordability and career readiness when planning their education.

- Parents remain committed to college savings despite market uncertainty, though many have adjusted contributions or investment strategies.

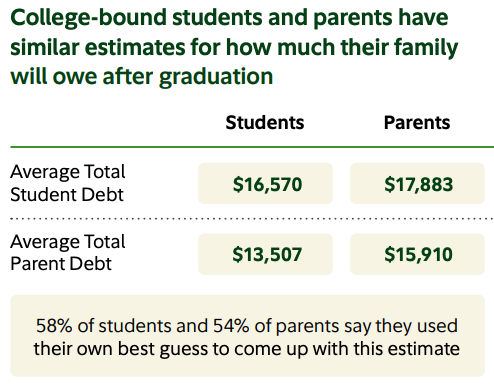

- Student and parent expectations for future student loan debt remain lower than what current tuition costs suggest they may actually face.

A new Fidelity Investments study finds that economic conditions over the past several years are influencing how high school students plan for life after graduation and what they’re willing to pay for college. More than half said living through recent financial instability has changed their view of higher education, prompting many to focus on affordability, career readiness, and long-term financial security.

The survey, which polled more than 2,000 students and parents, shows a steady increase in the percentage of college-bound students prioritizing cost when choosing where or how to pursue higher education. In 2025, 47% listed cost as their most important factor, up from 40% in 2021. Among high school seniors, the figure rose to 54%.

Career outcomes weigh heavily too. 65% of students want a job in a field they care about, 61% seek salaries that support long-term goals, and another 61% aim for stable careers. These numbers have climbed since 2021, when fewer than 55% rated these as top priorities.

While most still plan on a traditional college route, interest in alternatives paths is growing. The share of students considering vocational or trade school as their primary option has tripled since 2021, from 2% to 6%, though still a clear minority.

Would you like to save this?

Parents Adjust Savings Amid Market Volatility

Parents are also rethinking their approach. 60% say they worry about market uncertainty affecting their ability to pay for college. Still, nearly three-quarters are continuing to save. Among those who changed their strategy, the most common steps include reducing savings amounts (45%), rebalancing investments to manage risk (31%), and using savings vehicles beyond 529 plans (29%).

A majority of parents (69%) say they feel grateful to have set aside some funds for college. More than half also feel optimistic that savings will enable their child to pursue higher education and accomplished for meeting at least part of their savings goals.

Use of 529 plans remains strong, with 55% of parents either currently saving in one or planning to. These tax-advantaged accounts can be applied to a wide range of education expenses, from college tuition to certain apprenticeship costs and even up to $10,000 in student loan repayment.

Debt Expectations Don’t Match Reality

The study reveals a potential gap between what families expect to borrow and what they might actually face. Students estimate they will graduate with about $16,570 in student loans, while parents put the figure at $17,883. Parent debt expectations are slightly lower, at roughly $15,910 by their own estimates.

Given that a single year at an in-state public university now averages $29,910, a family covering even half the cost with loans could be looking at closer to $60,000 in debt by graduation. Plus, our data shows that the average student loan debt at graduation is roughly $37,000.

Loan repayment timelines are another area where expectations may be overly-optimistic. Students predict it will take 8.9 years to pay off their own loans and 6.8 years to clear any parent-held debt. Parents estimate 9.7 years for student loans and 7.6 years for parent loans. Both groups expect monthly payments of more than $500.

The reality is that the average undergraduate pays off their loans in 17 years, and graduate students over 20 years. The assumptions families are making on student loan repayment are half of the reality.

Encouragingly, discussions about how to pay for higher education are common. 67% of students and 70% of parents report having these conversations, with the share rising to 75% among seniors. We believe that having these open, honest conversations is critical to making better college decisions. It’s worrying, though, that one-third of families are still going into college blind on the finances.

What To Think About Moving Forward

The Fidelity report suggests a gradual but significant shift in how families approach higher education.

Students are weighing cost and career outcomes more heavily, and parents are adapting their college savings strategies to economic conditions without abandoning long-term goals. While many families have aligned expectations, the data highlights the risk of underestimating future loan debt.

As conversations about cost, value, and repayment become more common, both students and parents may be better positioned to make choices that balance educational ambitions with financial stability.

Editor: Colin Graves

The post Fidelity Study Reveals Changing Views On Student Debt appeared first on The College Investor.