Key Points

- As of September 2024, the PSLF weighted average rule became the standard for federal loan consolidation.

- Instead of restarting your payment count or defaulting to your oldest loan, the new rule assigns a weighted average of qualifying payments to your new consolidation loan.

- Borrowers with uneven loan histories may see their count drop especially if their largest loan has fewer payments.

Public Service Loan Forgiveness (PSLF) has long been a lifeline for teachers, nurses, social workers, and other public sector employees carrying student loan debt. But the rules around consolidation (the process of combining multiple federal loans into one Direct Consolidation Loan) have shifted over time, often leaving borrowers confused.

Under earlier rules, consolidating wiped out your progress entirely, resetting your PSLF payment count to zero. Then came a one-time PSLF waiver, which let borrowers lock in the highest count from any loan – a major win for those with older debts.

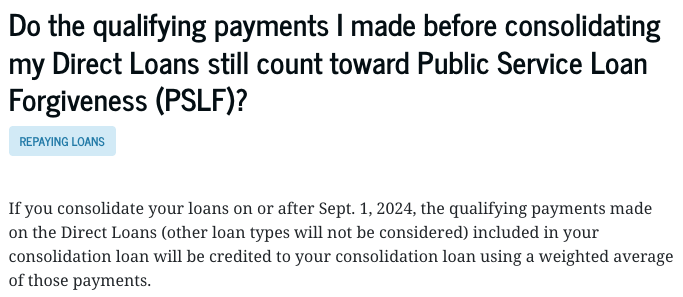

That waiver ended in 2023. Now, as of Sept. 1, 2024, the Department of Education has adopted the weighted average rule as the default. This new rule assigns a weighted average of your PSLF payment count to your new consolidation loan. You can see the current PSLF weighted average rule on the Department of Education’s website:

Would you like to save this?

How The PSLF Weighted Average Rule Works

The new rule calculates your payment count by blending your loans based on:

- Each loan’s balance

- Each loan’s qualifying PSLF payments

The formula looks like this:

(Loan Balance A x Loan Payment Count A) + (Loan Balance B x Loan Payment Count B) + (…) / Total Loan Balance

The impact of this weighted formula is that larger loan balances carry more weight. If your biggest loan is far behind in payments, it can drag down the average. Conversely, if your largest loan is well ahead, it can pull the number up.

Example:

Sam is a teacher and has $15,000 in undergraduate loans with 100 payments, but recently went back to school to get his master’s degree, and his new Grad PLUS loan has a balance of $60,000 with no qualifying payments.

If he consolidated his loans after grad school, the new consolidation loan would have just 20 qualifying payments! That seriously sets Sam backwards – from 100 qualifying payments to just 20 qualifying payments.

Here’s the formula:

($15,000 x 100) + ($60,000 x 0) / $75,000 = 20

Flip the balances, and the outcome changes. If the larger loan had 100 payments, his average would jump up significantly.

But let’s face the reality – undergraduate debt isn’t usually larger than later loans from grad school. And earlier debt is also more likely to have higher payment counts than debt you recently took out.

History Of PSLF Payment Counts And Consolidation

Dealing with PSLF payment counts has always been confusing because the rules around consolidation have changed multiple times in the last few years.

- Before 2021: Consolidation reset your PSLF count to zero.

- Waiver Period (2021–2023): Borrowers could consolidate and keep the highest payment count from any loan.

- Now (Sept. 2024 onward): The weighted average is the permanent default.

These data points are important because the recent changes enabled more borrowers to get actual loan forgiveness. For example, the PSLF Waiver enabled 758,800 borrowers to get $52.1 billion in student loans forgiven.

This shift matters most for borrowers with a mix of old and new loans. Those who consolidated during the waiver window likely locked in the most favorable counts. Those consolidating today need to be more strategic because it could still reduce your overall payment count.

Should You Consolidate Your Loans If You’re Going For PSLF?

Generally, no. It does NOT make sense to consolidate your loans. Remember, each PSLF-eligible loan will maintain its own payment count if you don’t consolidate.

However, there are still a few rare scenarios where it can make sense:

Consolidation makes sense if you have:

- FFEL or Perkins loans, which don’t qualify for PSLF without consolidation. However, very few of these FFEL or Perkins loans are left in existence. Furthermore, the current weighted average rule doesn’t allow their time to count for PSLF historically. Only payments moving forward would count.

- Parent PLUS loans, which require consolidation and specific repayment plans to qualify. However, the potential to access PSLF for Parent PLUS Loan borrowers ends June 30, 2026.

- Newer loans with little PSLF history, where the weighted average won’t erase much (if any) progress.

But it could hurt if you have:

- One or more loans with a high PSLF count and others with very few payments.

- A large loan with minimal progress, which could pull down your average.

Borrowers close to the 120-payment mark should be especially cautious. Even a small reduction in counts could add years to repayment.

How To Check Your PSLF Payment Count?

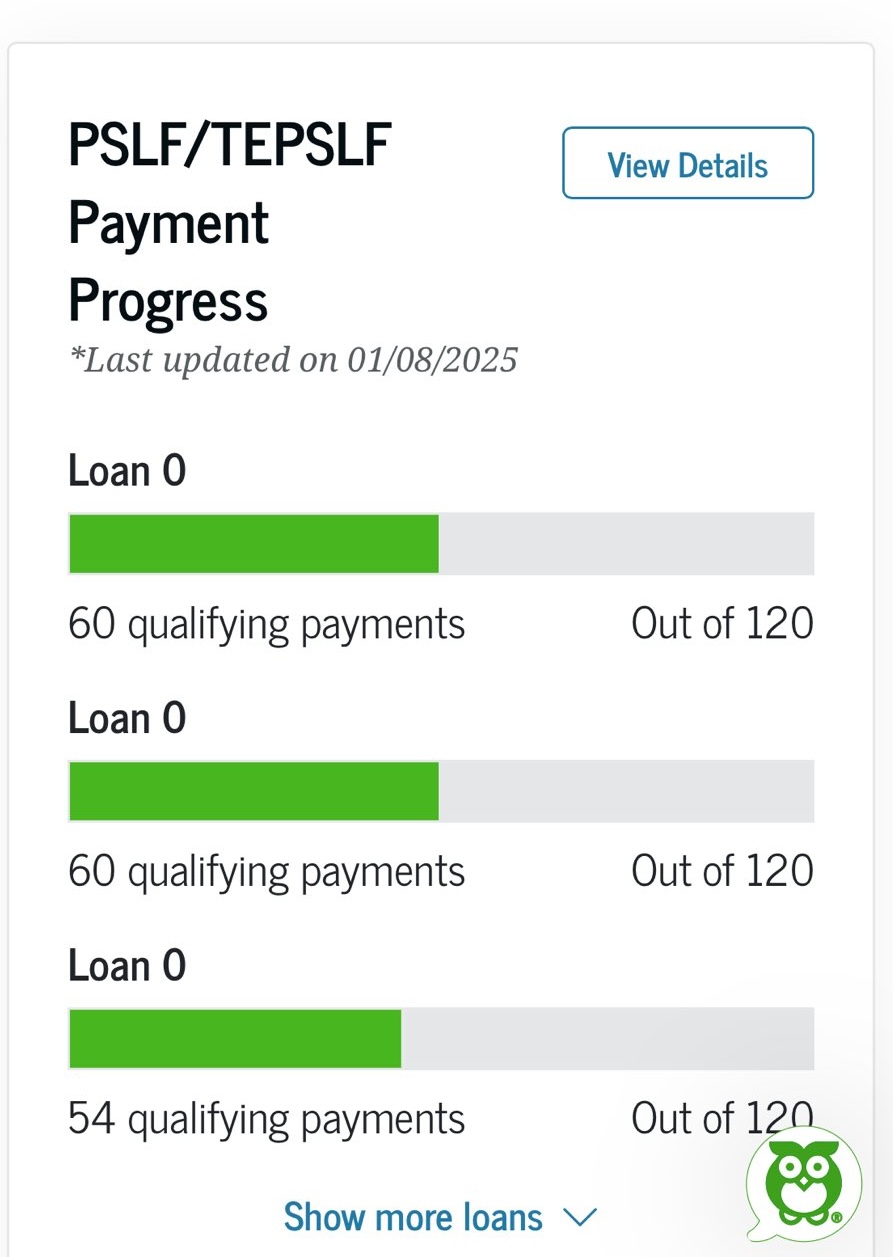

You can view your progress on StudentAid.gov:

- Log in and select “My Aid” from your dashboard.

- Scroll to Loan Breakdown.

- Click on a loan to see details.

- Look for “PSLF Payment Count.”

The green banner in the sidebar may also show the details without having to dive in:

If your numbers look outdated (particularly after recent loan consolidation) you can submit a new PSLF Employer Certification Form to trigger a review.

What Borrowers Should Do Next

The PSLF weighted average rule doesn’t erase progress, but it changes how it carries over to a new consolidation loan. The results depend entirely on your loan mix.

Key steps to consider:

- Run the numbers before consolidating, especially if you’re close to forgiveness.

- Prioritize consolidation if you hold FFEL, Perkins, or Parent PLUS loans, since they don’t count otherwise.

- Check your payment counts regularly at StudentAid.gov to ensure accuracy.

- Stay updated by subscribing to The College Investor’s Student Loan WatchDog Newsletter.

For many public service workers, consolidation isn’t necessary – and actually could be harmful. But in some scenarios, it’s required. A careful calculation now could save years of repayment later.

Common Questions

Q: Does consolidating reset my PSLF payment count to zero?

A: No. Under the new weighted average rule, your payments are averaged across loans based on balance and payment history. But your overall PSLF count may go down if your largest loan has fewer qualifying payments.

Q: What if I consolidated during the PSLF waiver period?

A: You keep the benefit of the waiver. Your payment count is based on your loan with the highest number of payments, not the weighted average. However, if you consolidate again, you fall under the new weighted average rules.

Q: Do FFEL or Perkins loans qualify for PSLF without consolidation?

A: No. FFEL and Perkins loans must be consolidated into a Direct Consolidation Loan to qualify for PSLF.

Q: What about Parent PLUS loans and PSLF?

A: Parent PLUS loans are eligible for PSLF only if consolidated, and the new loan must be repaid under the Income-Contingent Repayment (ICR) plan, or Income Based Repayment (IBR) in the future.

Q: Where can I see my current PSLF qualifying payment count?

A: Log into StudentAid.gov → “My Aid” → Loan Breakdown. Each loan shows a “PSLF Payment Count.” If it looks wrong, submit a new PSLF Employer Certification Form to trigger a review.

Don’t Miss These Other Stories:

Editor: Colin Graves

The post PSLF Weighted Average Rule Explained appeared first on The College Investor.