Key Points

- Tesla investors are threatening to pull millions in assets from Charles Schwab after several Schwab ETFs voted against Elon Musk’s proposed $1 trillion Tesla pay package.

- The votes put Schwab at odds with some retail shareholders who credit Tesla’s board and Elon Musk with exceptional returns.

- Some high-net-worth Tesla investors say they’ve already begun transferring accounts to rival brokerages, including Robinhood, in protest.

Charles Schwab is facing growing backlash from a vocal group of Tesla (NSQ:TSLA) investors who say the brokerage firm’s proxy votes contradict shareholder interests. The controversy stems from several of the firm’s exchange-traded funds (ETFs) – representing roughly seven million Tesla shares – voting against Tesla’s proposed CEO compensation package for Elon Musk.

The pay plan, potentially worth up to $1 trillion over the next decade, was designed to retain Musk through a performance-based stock award. Tesla’s board argued that the plan was essential to keeping Musk’s focus on the company as it pursues ambitious goals, including producing 20 million vehicles annually and developing autonomous “robotaxis” and humanoid robots.

But Schwab’s ETFs (including the Schwab U.S. Broad Market ETF, Schwab U.S. Large-Cap ETF, and Schwab Fundamental U.S. Broad Market ETF) voted to reject the package.

That decision has triggered an open revolt among a segment of Tesla’s retail investor base, many of whom are active on social media and have organized around the issue.

We reached out to Schwab for comment on this story, and as of publication, they have not responded. We will update the story if we receive more information.

Would you like to save this?

Investors Are Moving Their Accounts

Jason DeBolt, with more than 240,000 followers on X (formerly Twitter), accused Schwab of “voting against one of the most successful corporate boards in history.” He claims that Schwab’s ETFs collectively represent a position of around seven million Tesla shares, and that his community of followers could control “tens or even hundreds of millions” of dollars in Tesla holdings.

Hey @CharlesSchwab – I need to speak with someone from Schwab Private Wealth Services this week. Please reach out via email, the mobile app message center, phone, or X DM.

Here’s why this is urgent: At least 6 of your ETF funds (around 7 million $TSLA shares) voted against… https://t.co/uSgPWnfTFc— Jason DeBolt ⚡️ (@jasondebolt) November 3, 2025

“If Schwab’s proxy voting policies don’t reflect shareholder interests, my followers and I will move our collective tens of millions in Tesla shares to a broker that does,” he wrote.

That sentiment is already translating into action. At least one Tesla investor has publicly confirmed moving $1 million in retirement assets from Schwab to Robinhood, citing both the ETF votes and Robinhood’s 3% transfer bonus for incoming retirement accounts. Others have pledged to follow suit if Schwab does not change course ahead of future votes.

As promised, I have moved my Roth (and my other retirement accounts, holding $1M worth of TSLA) out of @CharlesSchwab and into @RobinhoodApp.

If Schwab does not vote in line with the Tesla Board on their ETFs, I will proceed with moving my taxable portfolio.

Robinhood is… pic.twitter.com/YqTn5QQFU4— Kevin Chau (@kchau) November 4, 2025

Schwab’s Fiduciary Dilemma

At the center of the dispute is a question that has long divided Wall Street: how ETFs should exercise their voting power.

As fund custodians, firms like Schwab cast proxy votes on behalf of ETF shareholders. These votes are guided by the firm’s internal proxy voting policies and often informed by third-party advisors such as Glass Lewis or Institutional Shareholder Services (ISS).

Schwab’s proxy guidelines generally emphasize board independence, transparency, and pay-for-performance alignment. According to reporting by Reuters, Glass Lewis argued that Musk’s package raised concerns about corporate governance and concentration of power, despite Tesla’s strong returns.

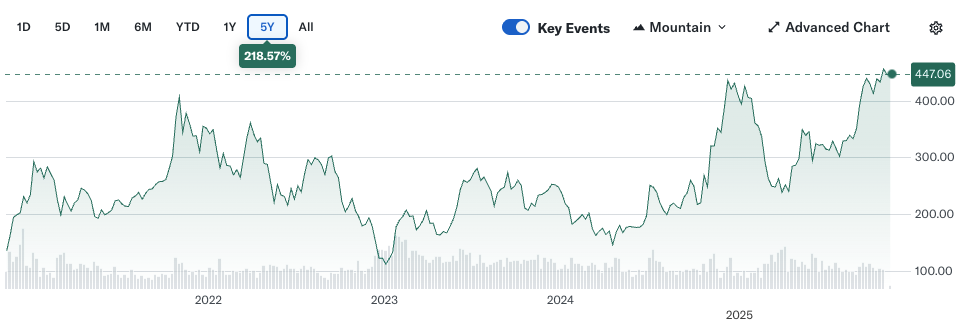

That approach, Schwab’s defenders might argue, reflects a consistent governance philosophy rather than a judgment on Tesla’s performance. Yet retail shareholders – especially those with concentrated holdings in Tesla – view the issue differently. To them, the vote represents a betrayal of a company that has delivered extraordinary long-term returns – over 200% in the last 5 years.

The challenge for Schwab is that ETFs aggregate votes from millions of investors with differing priorities. Some care about governance discipline while others may only care about financial performance. Schwab’s fiduciary duty requires it to consider the collective interests of all shareholders, not just the most vocal segment.

Still, the backlash illustrates how modern proxy voting can create unexpected reputational risks for large asset managers, particularly when social media amplifies shareholder movements in real time.

Impact On Schwab And The Broader Market

While there is no public data yet on the scale of account transfers from Schwab, the growing online campaign could test investor loyalty at a time when competition among investment apps is intensifying.

Robinhood, for example, is aggressively courting disaffected investors with transfer incentives and a user base that skews toward retail traders familiar with Tesla’s community culture.

Fidelity and Vanguard, which also manage Tesla-heavy funds, have so far avoided similar backlash – though both have faced questions about their own voting policies in recent years.

For Schwab, which manages over $9 trillion in client assets, even a modest outflow of Tesla-focused investors may not be financially significant. It’s still one of the largest asset managers in the world.

But reputationally, it highlights a delicate tension: how to balance responsible stewardship with the expectations of passionate retail shareholders who view corporate leadership through a performance lens rather than a governance one.

What Investors Should Know

Investors should be aware that when they hold Tesla (or any stock) through an ETF or mutual fund, they do not directly control how those shares are voted. The fund manager makes those decisions under its proxy voting policies.

Those who wish to vote directly on corporate matters, such as executive pay packages, need to hold shares directly in a brokerage account in their own name rather than through pooled funds.

Retail investors who want their votes counted in line with their personal views may need to consider direct ownership of shares versus investing in an ETF or fund.

Don’t Miss These Other Stories:

Editor: Colin Graves

The post Schwab Faces Backlash Over ETF Votes Against Elon Musk’s Tesla Compensation appeared first on The College Investor.