Key Points

- The SAVE repayment plan remains in legal limbo, and borrowers are simply waiting for a date on when the administrative forbearance will end.

- The One Big Beautiful Bill officially eliminates SAVE and move borrowers into a version of IBR, but the max legal timing is June 2028.

- The timing of repayment for SAVE borrowers is possible in late 2025, but more likely by mid-2026.

The future of student loan repayment for SAVE borrowers is now caught between a pending court ruling and how quickly the Department of Education can execute on the One Big Beautiful Bill (OBBB) that just passed.

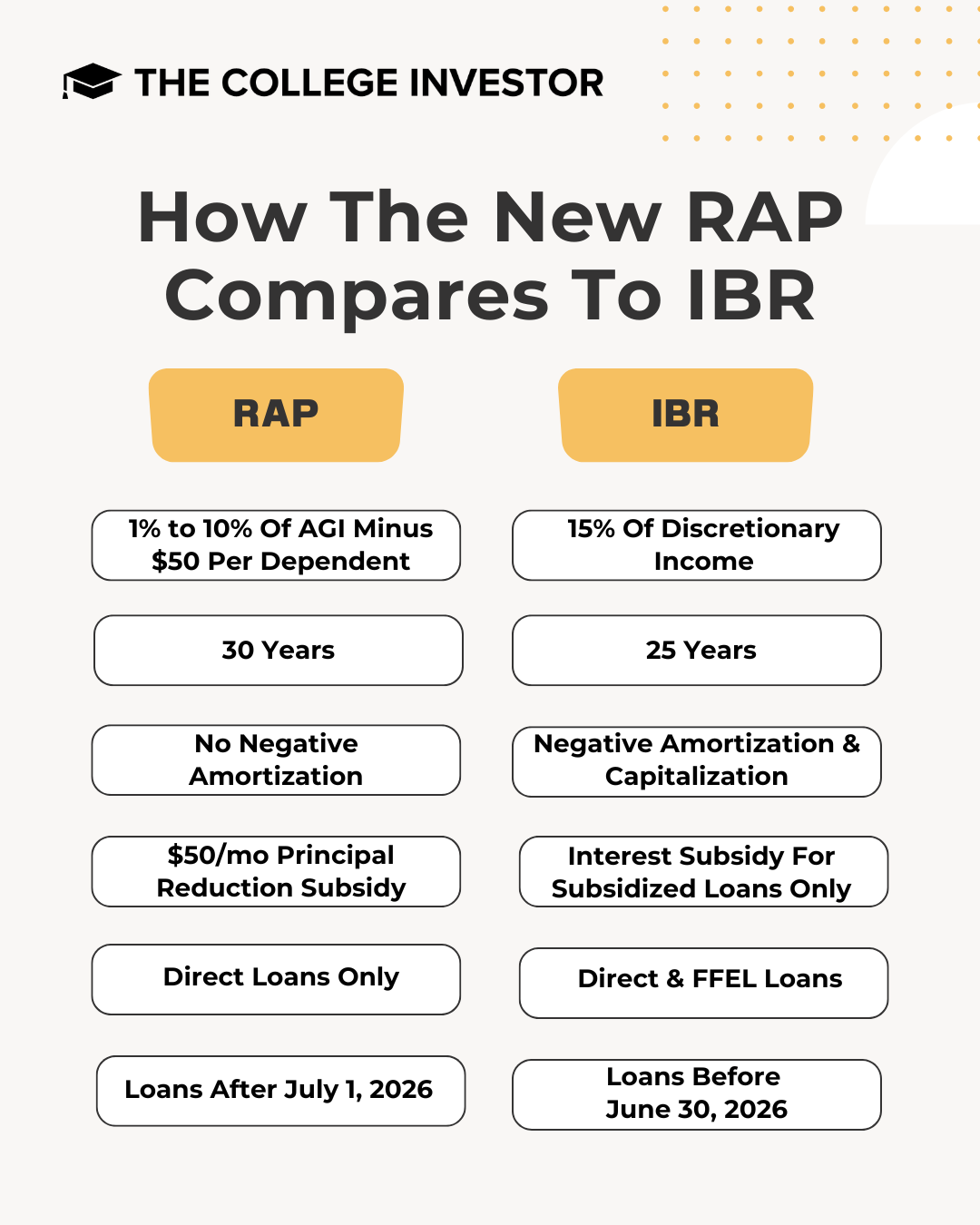

Borrowers in administrative forbearance under the SAVE (Saving on a Valuable Education) plan know the future now, but they don’t know when. The OBBB makes it clear that borrowers in the SAVE forbearance will migrate to amended IBR, or have an option to enroll in the new Repayment Assistance Plan (RAP) in 2026. But the question as to when remains.

When will the SAVE forbearance officially end and borrowers be required to make payments again? Note: This isn’t about interest accruing – that’s starting back on August 1 and no payments are still due. This is about when payments may resume.

Several scenarios are on table for SAVE repayment resuming

- ED forces SAVE borrowers into repayment before July 2026: The Department of Education could return borrowers to repayment as soon as December 2025, then still force them to move repayment plans between July 2026 and June 2028.

- The Department of Education keeps borrowers in forbearance until migration in mid-2026: The Department of Education simply migrates all borrowers on SAVE to amended IBR by July 2026, coinciding with the RAP plan beginning.

- Other Timelines: Literally any timeline could happen between December 2025 and June 2028. But it would be rare to keep borrowers in forbearance until 2028, and logistically it would be a nightmare for loan servicers NOT to coordinate with the other changes happening.

The fastest option could see payments start again is the very end of 2025, though it’s the least likely, because SAVE is enjoined they cannot simply restart SAVE payments. Our opinion is the highest probability of payments resuming is mid-2026 for SAVE plan borrowers.

Here’s a more in-depth look at these three scenarios.

Editor’s Note: This has been updated to reflect the upcoming negotiated rulemaking and the latest court status update.

Would you like to save this?

@thecollegeinvestor Replying to @JKeibler What’s next for SAVE plan borrowers? Here are the most likely scenarios in our opinion. #greenscreen #studentloans #studentloandebt #studentloanforgiveness ♬ original sound – The College Investor

Option 1: ED Forces Borrowers Out Of SAVE Quickly

The next court status update is going to be October 3, 2025, during which it’s likely the Department of Education will preview some plans for the transition out of SAVE, if they don’t do so before that. They didn’t announce anything on the previous status update.

The Department of Education could force borrowers to other available repayment options currently allowed (such as IBR), but this scenario seems unlikely because of the logistics, and potential legality.

It’s important to remember that SAVE being found illegal means they cannot likely restart you on your old SAVE plan payments. They would need to migrate you to another plan.

The department would likely offer a temporary grace period or administrative forbearance while applications are processed, but full repayment would resume only as early as December 2025.

However, there could be a scenario where, if borrowers don’t select a new plan by a certain date, they will default back into the Standard 10-year plan (then move to default if they still don’t take action).

This seems like a challenging timeline since this would likely require a new round of borrower communications and system updates, informing affected individuals that they must choose between remaining IDR plans such as IBR or PAYE. And knowing these plans are simply ending 6 months later… why do this? (That’s our opinion)

Option 2: Clean Migration To IBR Or RAP

Now that the budget reconciliation bill has passed and we know RAP is going to be law, the “cleanest” path forward seems to be to coordinate the end of the SAVE forbearance with the start of RAP and Amended IBR.

We know that borrowers in the SAVE forbearance will automatically migrate to IBR, and after July 1, 2026, can enroll in RAP.

It seems the most reasonable that this could be an easy coordination for both timing, communication, and execution to have the SAVE borrowers begin payments at this time.

We don’t view it likely that borrowers who’ve already been told they are in forbearance until November 2025 would see that timeline shortened. When you also combine that with the logistical workload required to migrate 7-8 million student loan borrowers in SAVE, again, mid-2026 seems more realistic. But, yes, the current forbearance periods end in late 2025 and we can’t deny that currently.

The timeline would look like:

- Review the final bill and setup any rule-making as needed (Rulemaking begins in September)

- Notify borrowers and update StudentAid.gov (2 – 4 weeks)

- Coordinate with loan servicers to update systems and setup amended IBR (1 – 3 months)

- Transition existing borrowers back into repayment on amended IBR with billing notices and due dates (3 – 6 months)

- Rule-making for RAP to start (6 – 12 months) – which the Department of Education just announced.

- RAP goes live in July 2026

This entire timeline seems like July 2026 should be the target restart date.

Option 3: Wildcard Timelines

It’s possible any timeline can happen, just less likely because of all the steps required.

For example, the law says that SAVE, ICR, and PAYE must be eliminated by June 2028. So, theoretically, these plans could last that long. But the beginning of the transition is July 1, 2026 – so anytime between those dates is also fair game.

The court or the Department of Education could expedite things to turn things back on – assuming they do so legally. That could be December 2025 for first payments due, or January 2026, or anything in-between. However, because borrowers cannot likely resume SAVE plan payments, restarting this quickly would require borrower action to move to an active repayment plan.

Again, because of the logistics required, communication required, and more, it’s unlikely that it would happen at an “off” timing. But we’ve seen stranger things. Especially in light of the ongoing IDR processing backlog.

What Happens Next?

Now that Congress has passed the Bill and President Trump should be signing it today, the Department of Education is going to have to get to work creating all the official rules and policies for these new plans. Then they have to coordinate with the loan servicers to get them going as well.

These things take time, effort, manpower (which the Department is lacking), legal analysis, and more.

Regardless, the 7 to 8 million borrowers in SAVE will have to make some decisions with their loans in the next six to twelve months. And that choice will be between amended IBR and RAP.

Don’t Miss These Other Stories:

Editor: Colin Graves

The post SAVE Student Loan Plan Timeline Estimates: What To Expect appeared first on The College Investor.